A Passive Fund Manager Would Be Most Likely

A greater passive share will likely create greater mispricings and more opportunities to generate alpha for active managers. Over the long term active management paid off most for small-cap mid-cap foreign stocks and intermediate-term bond funds which performed better than index funds and were more likely to stay open.

Active Vs Passive Fund Performance 5 Learnings From The Second Half Of 2019 Morningstar

Passive Managers will most likely.

. Passive overtook active around August 2018 and its market share stands at about 54. We believe that combining active and passive management is the best way to construct a portfolio focusing active strategies in areas where they are. 2png - Portfolio Management.

A passive strategy does not have a management team making investment decisions and can be structured as an exchange-traded fund ETF a mutual fund or a unit investment trust. Even in passive investing thoughtful manager selection can improve the likelihood of positive investment outcomes according to Morningstar. ABC fund seeks capital appreciation.

After investing Thus after trading costs the average return for active investors will be less than for passive ones. So last years winning fund will likely have a difficult time staying on top for long. View the full answer.

Because they mirror a market index theres no need for a manager to handpick individual holdings. Experts are tested by Chegg as specialists in their subject area. Defining a Portfolio 3 Go Manager Fullscreen Back BMC KNOWLEDGE CH ECK A passive fund manager would be most likely.

Passive vehicles lead in the 116 trillion US. A passive fund manager would be most likely to do which of the following. It fails to consider the price relative to earnings or other fundamentals that drive value.

Who are the experts. Passive or index fund management is typically where the portfolio is designed to parallel the returns of a particular market index or benchmark as closely as possible. It invests in either growth stocks or.

Most indices are market cap weighted which results in passive allocation based on size Market cap. A fund manager or investment manager who manages the investment. The fund invests primarily in common stocks of domestic and foreign issuers.

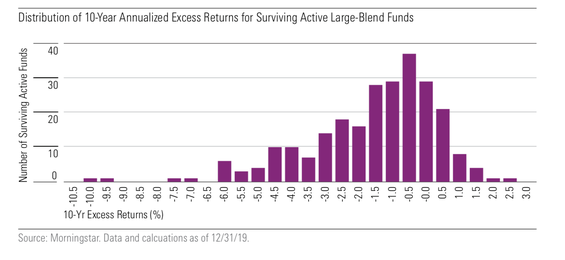

Clearly high costs are a very high hurdle for active fund. The performance of a passive fund should mirror the index its tracking which means the fund will share the ups and downs of the index. A passive strategy does not have a management team making investment decisions and can be structured as an exchange-traded fund ETF a mutual fund or a unit investment trust UIT.

Hedge funds are most likely to. Match the return and risk of a broad market index. KNOWLEDGE CHECK A passive fund manager would be most likely to do.

Students of investments were taught that statistically a reasonable number of securities for a diversified portfolio is a minimum of 30. For example the second cheapest quintile of funds was twice as likely to outperform as the most expensive funds 30 vs. 100 37 ratings Match the funds performance to the benchmark in.

A passive or strategic style is as the name implies relatively inactive rather than active. The opposite is passively managed funds which generally are index funds or exchange-traded funds. A passive fund manager would be most likely to do which of the following.

Have a portfolio that matches a particular index or sector. We review their content and use your feedback to keep the quality high. D The ability to trade throughout the day for NAV Passive portfolio management is also referred to as index fund management.

Most mutual fund managers and advisors invest with an active approach. Third the link between ETF trading and underlying security prices deserves further study. The profile of an actively managed mutual fund hypothetical reads as follows.

Saying the investments are likely to. Passive management is most common on the equity market where index funds track a stock market index but it is becoming more common in other investment types including bonds commodities and hedge funds. Impose capital lock-up periods.

Domestic equity-fund market will likely expand we believe. A passive strategy does not have a management team making investment decisions and can be structured as an exchange-traded fund ETF a mutual fund or a unit investment trust. An aggressive growth manager would actively pursue specific growth securities such as stocks and not allocate funds between bonds real estate or other asset categories.

Passive fund managers make no active decisions potentially resulting in less trading which reduces fund expenses and potential taxable distributions to shareholders. An analysis of recent stress episodes compares the stability. Passive or index fund management is typically where the portfolio is designed to parallel the returns of a particular market index or benchmark as closely as possible.

Credit rating agencies are best described as providing. Furthermore on average any excess expected return generated by. A strictly passive portfolio manager is most likely to.

A passive fund manager would be most likely to do which of the following. Increasing the hurdle rate for a hedge fund manager will usually lead to a.

5 Tools To Evaluate Mutual Funds Alpha Sharpe Ratio Beta R Squared Financial Life Hacks Mutual Funds Investing Economics Lessons

Pin By Ezra Zask On Empowering Investors Financial Advice Financial Financial Planner

7 Reasons Why Hiring A Property Management Company Will Put More Money In Your Pocket Real Estate Investing Rental Property Property Management Marketing Real Estate Management

No comments for "A Passive Fund Manager Would Be Most Likely"

Post a Comment